Even the most seasoned travelers sometimes feel confused about travel insurance — what’s out there, what it covers, whether or not they need it.

While coverage and policies vary from state to state, of course, here are some basics of travel insurance to get you started:

1. There are five main types of travel insurance. What you might need depends largely on what kind of trip you’re taking, what kind of traveler you are, and how frequently you travel. The five main types are:

• trip cancellation and interruption (full or partial reimbursement for a trip you need to cancel prior to departure, a trip that gets cancelled because a tour company or resort goes out of business, or a trip that gets cut short for a wide variety of reasons)

• medical (for health issues that occur outside of your normal coverage area)

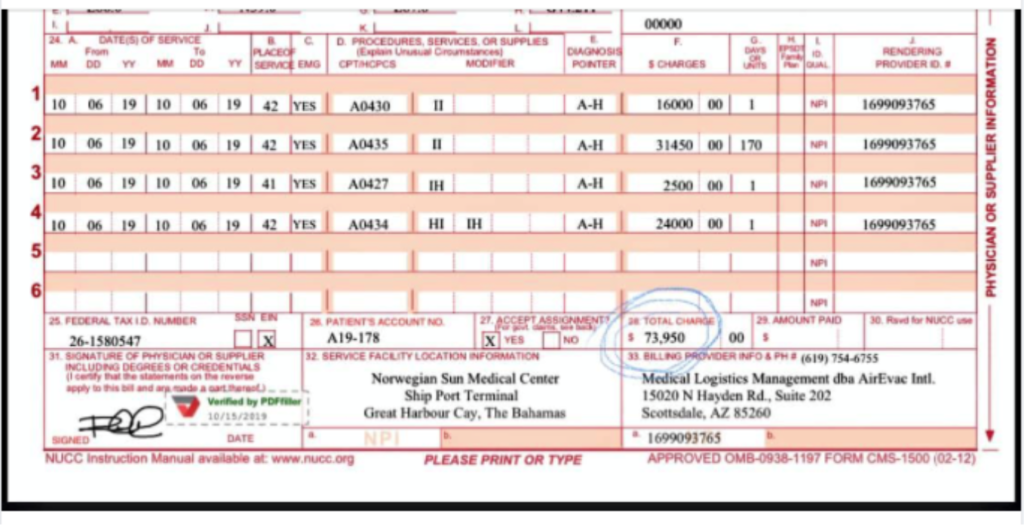

• evacuation (due to disaster, dangerous weather, political emergency, or medical emergency)

• baggage (reimbursement for lost, stolen, or damaged baggage)

• flight insurance (also called “crash coverage,” this is basically a life insurance policy that covers you while you’re on the plane, in the event of a statistically-rare crash)

“The various types are generally sold in some combination — rather than buying only baggage, medical, or cancellation insurance, you’ll usually purchase a package that includes most or all of them. If you want just one type of coverage in particular — such as medical — ask for that (though it might come with a little cancellation or baggage insurance, too). ‘Comprehensive insurance’ covers all of the above, plus expenses incurred if your trip is delayed, if you miss your flight, or if your tour company changes your itinerary.”

2. Just because you have health insurance at home does not mean that it will cover you on your trip. You need to check the ins and outs of your particular health insurance policy. It may cover you while you travel, but many do not. In fact, some insurance policies don’t even cover health emergencies experienced on foreign-flagged vessels — which is what most cruise ships are. Check with your provider, ask your travel agent for suggestions, and of course direct any insurance-related questions to the provider. As Steves puts it, “Before purchasing a policy, ask your insurer to explain exactly what’s covered before and after you get to the hospital.”

3. Avoid purchasing travel insurance from the company that’s also hosting your trip. The reason for this? If that company goes out of business, chances are, so does their insurance. Also, often times their insurance coverage is not as robust as third party insurance companies.

4. Some companies offer comprehensive coverage that can serve as your primary coverage while you’re traveling. What does this mean, and how can it benefit you? It means that the insurance company will pay first, regardless of what other insurance you have. They don’t even inquire about additional insurance, saving you tons of paperwork and out-of-pocket expenses. RoamRight and TravelGuard are two such companies that provide these policies as an option.

5. Weigh the cost of the trip with the cost of insurance. If you just bought a $79 ticket for a quick weekend in Chicago — is it worth it? Maybe, maybe not. If, however, you’re headed out on a once-in-a-lifetime trip that you’ve been saving for for months, travel insurance is likely a great idea.

If you’re looking to maximize your fun and minimize your risk, travel insurance should be part of your vacation package. Take your time, ask questions, and find what plan works best for you and your family. It is also a good idea to purchase travel insurance prior to you making your final payment. Particularly if you want primary travel insurance, as they usually have a cut off date to purchase "x" days before departure. I strongly urge anyone traveling these days should have travel insurance!